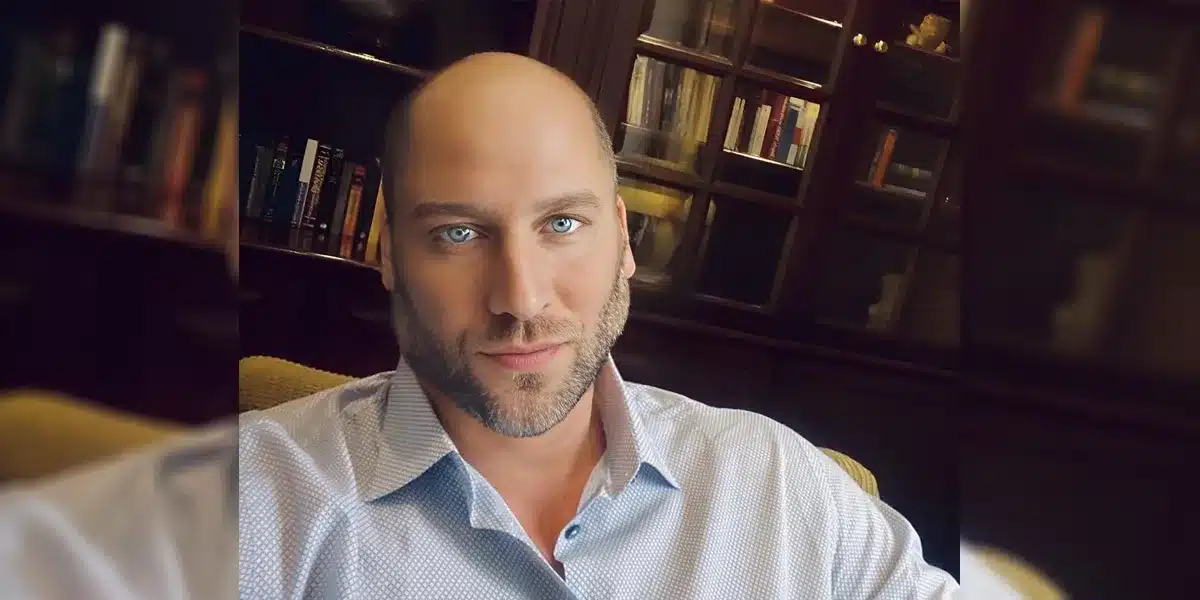

Hedge fund manager Paul Regan, the founder of Next Level Holdings LLC and financial engineer of a guaranteed 24% return, defies expectations. On the one hand, he is exactly what you would expect of a man who is turning the investment industry upside down: highly analytical, methodical, and visionary. However, he is not your typical Wall Street shark. This is, after all, the guy who practices the Seven Principles of Bushido each day. How did someone who can quote Sun Tzu, the legendary military strategist from ancient China, end up leading a revolution of sorts in America’s financial sector? We sat down with Regan to learn more about his background, including why he thinks that in 2023, power is finally shifting to investors.

“I have been a hedge fund manager for over 20 years, and the investment space still fascinates me, in part because it presents limitless opportunities if you work hard,” says Regan. “I also love traveling and have spent a lot of time in Colombia, where I donate to organizations that help underprivileged children. My time abroad has shown me how an event in a foreign country – for example, the outcome of an election or the discovery of a natural resource – can impact the market here in the United States or elsewhere. It is incredibly interesting to me how the world’s financial markets are so intricately connected.”

With this interest in world affairs, it is perhaps not so surprising that Regan’s investment strategy, which guarantees a 24% return on arbitrage-trading products that are backed by dedicated insurance policies, was inspired by China’s Sun Tzu.

“He was a master of agile warfare and preferred to win without fighting or, if that wasn’t possible, to pick the easiest battles,” Regan explains. “That always made sense to me. Why would you make things harder for yourself than they have to be? That’s why at Next Level Holdings, we follow Sun Tzu’s example and stick with our strengths to run our funds. We don’t try to step beyond what we do best.”

Also somewhat unusual for someone who is reinventing how to save for retirement is Regan’s reluctance to be in the spotlight. While he has been a keynote speaker on several occasions and has been offered guest spots by CNBC and other major outlets, he is guarding his privacy and that of his family.

“I have been having a great time using arbitrage to turn over my own capital in non-traditional markets 3-4 times every 30 days. 9-12% monthly returns are fantastic,” says Regan. “I like being small and agile, so I could keep going this way and be just fine. However, truthfully, this strategy can help a lot of people attain the lifestyle they have dreamed of. I get it – what hedge fund manager hasn’t said that before?”

Regan asks you to consider this: by increasing its monthly transaction volume, Next Level Holdings can generate returns of around 80% per annum after expenses. Because its product is backed by licensed and regulated major insurance carriers, all of whom carry investment-grade ratings from AM Best, the credit rating issuer for insurance carriers, roughly one-third of those returns, or around 24%, go straight back to investors in Next Level Holdings’ fund.

“That’s why I am doing this – I can make a difference in other people’s quality of living,” Regan says. “And, I’m doing it with a strategy that I developed and refined with my own capital. Investors know that I have skin in the game, which is essential for a hedge fund manager.”

While Regan has spent much of the past few years developing his products, he still makes time to cut loose a little. How does a man who has read Sun Tzu’s The Art of War five times let his hair down?

“Rock climbing, scuba diving, skydiving – I’m a huge adrenaline guy. You name it, and I’ve probably done it,” Regan answers. “Basically, any extreme sport that pushes me to test my mental fortitude and self-imposed psychological and physical limitations, I am all in.”

It makes sense, then, that Regan is focused on testing every preconceived idea we have about investments. Anyone who jumps out of a perfectly good airplane is not going to be deterred by the way things have always been done.