By: Vanilla Heart Publishing

The insurance industry has always followed an inherently conservative approach to marketing regarding processes and channels and, hence, was heavily entrenched in established methods and familiar channels. In the wake of changing customer expectations and the increasingly widespread usage of technology, insurers have had to make a strategic shift in their marketing strategy to remain relevant. In this direction, innovation is the need of the hour. For instance, firms are discovering new ways of developing customer engagement, attracting agents, and building brand loyalty through digital channels that can help reach their target audiences more effectively.

Innovative advertising campaigns have greatly helped the insurance industry increase brand visibility and deeper relationships with the public. Insurers create and use social media and content marketing as well as interactive tools to propose personalized experiences for potential customers to be targeted and attract new business, but through engagement and loyalty initiatives as well, help retain existing clients.

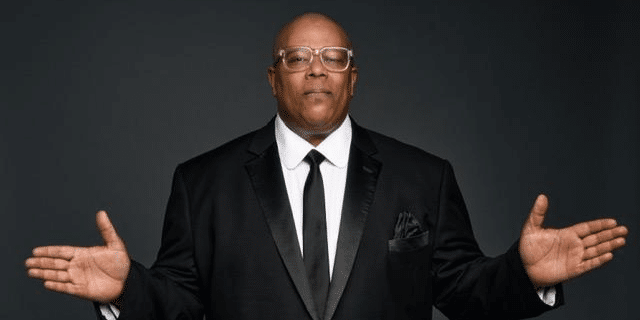

One company that exemplifies innovation in the insurance marketing space is the agency led by Justin Brock. The former Marine Corps and the president of Bobby Brock Insurance has defined new frontiers for how insurance would be marketed and perceived for this firm, embracing digital tools and less conventional methods. This was not about selling more insurance products but building community loyalty through engagement and education.

Unique Marketing Campaigns Led by Brock

Brock has spearheaded various innovative campaigns to set this insurance company apart in the marketplace. One of these was developing educational materials that simplify Medicare and health insurance for the consumer. The organization informed beneficiaries of options through webinars, videos, and blog posts to empower them with proper information.

Second, Brock’s agency has engaged through social media to communicate directly with clients. Two-way communication involving social media posts and content that has built an online community interested in sharing knowledge and experiences regarding insurance matters has assisted in promoting brand awareness, besides creating a sense of belonging among the client and which may lead to increased referrals.

Customer involvement and engagement strategies are crucial to generating loyalty in the insurance industry. Brock’s marketing strategy focuses on individualized communication, follow-ups, and creating an engagement process that leaves the client feeling that the relationship with their agency is valuable. For instance, his agency can track interactions and preferences using customer relationship management systems. This means tailoring its marketing message toward better fitting a person’s needs.

Customer Engagement and Loyalty Strategies

Brock’s agency is renowned for holding onto a relationship with its customers long after purchasing a policy. Frequent phone calls, news updates, changes made to individual policies, and newsletters are reminders to keep them informed and interested.

Also, the loyalty cards refunding clients on consistent business have been part of Brock’s tactic. For instance, discounts, extra coverage options, or exclusive content may incentivize customers to keep sticking to the brand. Building a culture of appreciation means creating an atmosphere where clients are recognized and appreciated, hence satisfied.

Another essential element of the approach developed by Brock is the element of agent recruitment and retention. A well-informed and motivated team is the primary factor in delivering superior service. The agency has exhaustive training programs for producing product knowledge, sales techniques, and customer service abilities. This investment in agent development is far from only performance improvement but also helps improve job satisfaction, lowering turnover rates.

Marketing Techniques for Agent Recruitment and Retention

Brock’s agency has devised specific marketing strategies to attract and retain the premier talent in the industry. It features a conducive workplace culture where one can expect career advancements appealing to a professional who desires a fulfilling career. Employee testimonials or success stories are usually aired across social media to show what working at Brock’s agency is like.

Networking events and conferences also have an essential role in recruitment. The agency is involved in the events organized by the industry, seeking fresh agents and maintaining good relations with them. This helps cultivate a sense of community, providing new agents with a stronger sense of connection and support, which can ease the transition into their roles and foster collaboration with the team.

The future of marketing in the insurance sector looks positive as the industry continues to evolve. Brock’s experiences and innovations show how companies adapt to changed consumer behavior and preferences. Technology is expected to remain central to marketing strategies as insurers take advantage of leveraging better data analytics to understand their client’s needs and preferences.

The Future of Marketing in the Insurance Sector

As for the future, the focus on marketing in the insurance sector could be even more customized and customer-experience-based. Insurers would have to employ advanced analytics and artificial intelligence to tailor and have greater transparency to meet the demands of their customers. The shift to a data-driven decision will enable firms to design targeted campaigns that touch their audiences.

The role of social media marketing will be expanded since digital communication overtakes conventional communication. Henceforth, firms will require a better online presence and engagement to attract and retain clients powerfully. Brock’s use of social media platforms offers an example of how agencies might adapt to these changes by maintaining consumer relationships.

Brock’s insurance marketing practice instills adaptability and participation. He focuses much on educating his customers, using digital space, and helping ensure that he has great relationships with his agents and clients. This has influenced the shift toward modern marketing practices within the insurance sector.

Published by: Holy Minoza