Image commercially licensed from: Unsplash

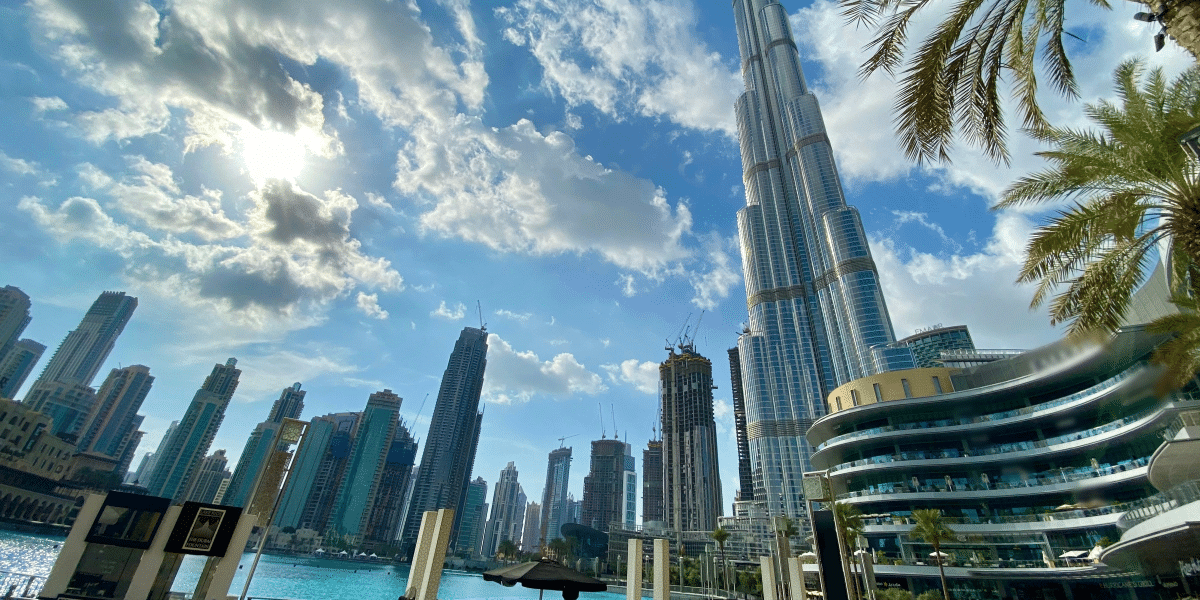

Off-plan property investment in Dubai offers the potential to realize profitable returns. A comprehensive understanding of the off-plan market and its unique characteristics is essential for success in this endeavor. This article provides an overview of the key features, benefits and challenges within the off-plan in Dubai for investment. It also explores how investors can identify attractive opportunities for return on their investments as well as measure risk levels associated with each venture. Through a better analysis of these factors, investors have the potential to reap significant rewards from off-plan investment in Dubai’s booming real estate sector.

Overview Of the Dubai Off-Plan Market

Due to its strong market trends and high rental returns, Dubai has attracted off-plan property investors. The city’s population expansion, economic possibilities, and Asian investors have increased real estate demand. Dubai’s infrastructure, international markets, and investment safety boost this.

Off-plan investors might profit on low entry prices before appreciation. Real Estate Investment Trust investors get several tax incentives, which may boost earnings even further. This sort of Dubai investment may be beneficial with proper location and pricing analysis.

Benefits Of Investing In Off-Plan Properties

Due to its advantages, off-plan property investing is growing in popularity. Off-plan investments provide tax benefits, rental rates, cheaper entry expenses, and capital appreciation possibilities.

Developer-discounted pre-construction house prices are the main advantage. These discounts are usually 10–15% below market value, giving purchasers quick equity profits. Buyers may benefit from lenders financing up to 95% of the buying price. Other advantages:

- Tax Advantages – UAE does not tax real estate revenues, making it an ideal investment for those seeking to maximize return without taxes.

- Rental Yields – Off-plan projects with pools, gyms, and other amenities attract tenants willing to pay higher rent than older buildings.

- Capital Appreciation Potential – Due to their lower purchase price, off-plan residences appreciate faster than finished flats in Dubai’s rising population and economy.

- Flexibility—Investors may choose their payment schedules, giving them greater control over how much they contribute.

Analyzing Risk Levels

Dubai off-plan property investing delivers lucrative rewards. Before investing, examine this venture’s risk. Risk assessment is essential for yield optimization and ROI:

- Analyze the developer’s financial stability – Investors must determine whether the firm has enough resources to finish development projects or is at danger of failing due to liquidity or other market conditions.

- Check Dubai’s foreign ownership, construction permission, and other rules before buying off-plan buildings.

- Review tax implications — Taxation regulations vary by nation and area in Dubai, so investors should understand how much money will be needed upfront and what taxes may be payable when selling or renting an off-plan home.

Locating The Ideal Property

To maximize earnings, Dubai off-plan property should be properly positioned. Off-plan investment site considerations include access to transportation networks and infrastructure, accessibility to amenities like retail centers and restaurants, safety, and rental revenue possibilities.

The investor should also consider Value Added Tax (VAT) exemption on chosen projects, reduced registration fees, mortgage registration fee waivers, and developer perks. These cost reductions may rapidly improve long-term earnings.

Here are some factors to consider while appraising homes to help investors make the best choice:

- Rental Income Potential

- Proximity to Transportation Networks & Infrastructure

- Safety Record of Area

- Available Tax Incentives

Working With A Reputable Real Estate Agency

Dubai off-plan property may provide high profits. A trustworthy real estate firm protects your interests and gets you the finest bargains. Tips for choosing an agency:

- Start by reading agent reviews, comparing costs, services, and specializations online.

- Check each agent’s fees, including commission and legal expenses. Understand these costs before hiring an agent.

- Ask relatives and friends who have bought off-plan houses in Dubai about which agents give the greatest discounts and services.

Dubai’s off-plan property market is lucrative for investors. Before investing, investors must evaluate land laws, regulations, financing choices, and the best investment opportunity. A good real estate agent can give local market information and help throughout the process. Investing in Dubai off-plan property may be beneficial with adequate research and competent guidance.

Read more on the official website https://dubai-property.investments/